为分片区块链实现经纪商收入和系统流动性最大化

Authors:

Qinde Chen,Huawei Huang,Zhaokang Yin,Guang Ye,Qinglin Yang

Abstract:

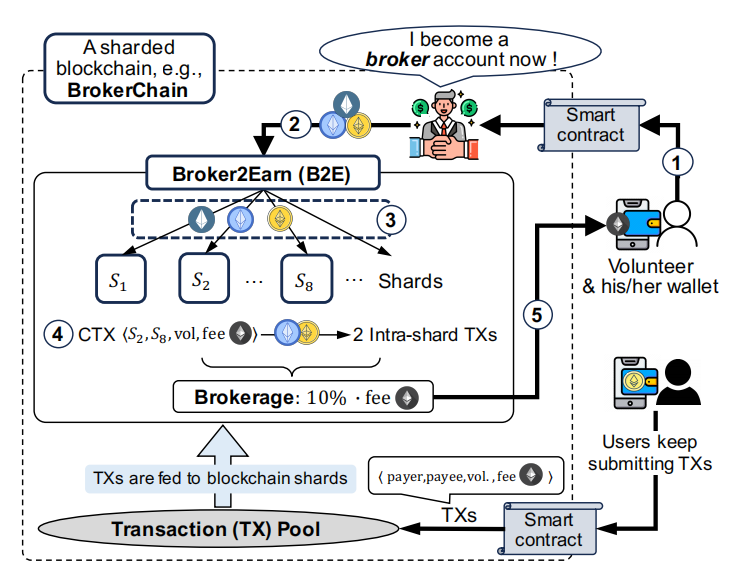

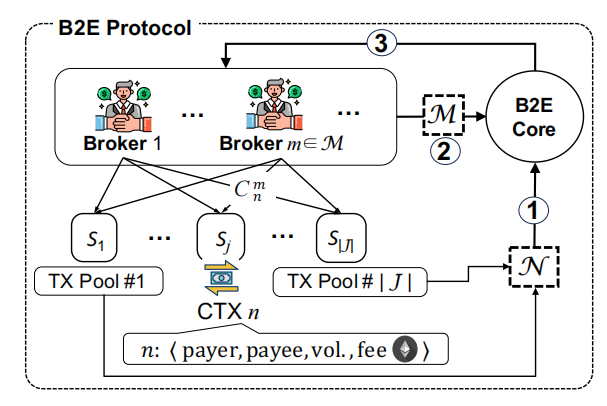

Cross-shard Transactions (CTXs) widely exist in sharded blockchains. CTXs have to endure large confirmation latency because they need to participate in consensus in both their source and destination shards. To diminish CTXs, plenty of state-of-the-art blockchain protocols have been proposed. For example, in BrokerChain [1], some intermediary broker accounts can help turn CTXs into intra-shard transactions through their voluntary liquidity services. Thereby, the original CTXs can be confirmed in blockchain shards quickly. However, we found that BrokerChain is impractical for a sharded blockchain because it does not consider how to recruit a sufficient number of broker accounts. Thus, blockchain clients do not have the motivation to provide token liquidity for others. To address this challenge, we design Broker2Earn, which is essentially a decentralized finance (DeFi) protocol that works as an incentive mechanism for blockchain users who choose to become brokers. Via participating in Broker2Earn, brokers can earn native revenues when they col-lateralize their tokens to the protocol. Furthermore, Broker2Earn can also benefit the sharded blockchain since it can efficiently spend each staked liquidity provided by brokers on diminishing CTXs. We formulate the core module of Broker2Earn into a revenue-maximization problem, which is proven NP-hard. To solve this problem, we design an online approximation algorithm using the relax-and-rounding technique. We also rigorously analyze the approximation ratio of our online algorithm. Finally, we conduct extensive experiments using real-world Ethereum transactions on both a transaction-driven simulator and an open-source blockchain testbed. The evaluation results show that the proposed Broker2Earn protocol demonstrates a near-optimal performance that outperforms other baselines, in terms of broker revenues and the usage of system liquidity.

sharded blockchain like BrokerChain

跨分片交易(CTXs)广泛存在于分片区块链中。ctx必须忍受巨大的确认延迟,因为它们需要参与源分片和目标分片的共识。为了减少ctx,已经提出了许多最先进的区块链协议。例如,在BrokerChain[1]中,一些中介经纪账户可以通过其自愿的流动性服务,帮助将ctx转化为分片内交易。因此,原始ctx可以在区块链分片中快速确认。然而,我们发现BrokerChain对于分片区块链来说是不切实际的,因为它没有考虑如何招募足够数量的经纪人账户。因此,区块链客户端没有动机为其他人提供代币流动性。为了应对这一挑战,我们设计了Broker2Earn,它本质上是一个去中心化金融(DeFi)协议,作为区块链用户选择成为经纪人的激励机制。通过参与Broker2Earn,经纪人可以在将其代币抵押给协议时获得本地收入。此外,Broker2Earn还可以使分片区块链受益,因为它可以有效地将经纪商提供的每笔抵押流动性用于减少ctx。我们将Broker2Earn的核心模块表述为一个收益最大化问题,并证明了NP-hard。为了解决这个问题,我们设计了一个使用松弛四舍五入技术的在线逼近算法。我们还严格分析了我们的在线算法的近似比率。最后,我们在交易驱动模拟器和开源区块链测试平台上使用现实世界的以太坊交易进行了广泛的实验。评估结果表明,拟议的Broker2Earn协议在经纪人收入和系统流动性的使用方面表现出接近最佳的性能,优于其他基准。

consensus.

PDF: https://www.researchgate.net/publication/379213048